How to Maximize Your Profits With Money Exchange Strategies

In the vibrant globe of currency exchange, tactical decision-making can considerably impact your bottom line. As we dive further right into the realm of currency exchange strategies, uncovering the nuances of each element can lead the means for an extra rewarding endeavor.

Recognizing Currency Markets

In the realm of global financing, comprehending the detailed operations of currency markets is vital for tactical decision-making and investment success. Money markets are dynamic and influenced by a myriad of factors, consisting of economic indicators, geopolitical events, and market belief. Understanding just how these variables influence exchange prices is crucial for investors and services wanting to optimize profits via money exchange methods.

Investors and traders evaluate these factors to anticipate possible currency movements and make informed decisions. A nation with solid economic data and secure political conditions may experience a strengthening of its money versus others.

Additionally, currency markets run 24-hour a day, 5 days a week, enabling for continual trading and reacting to international occasions in real-time. This continuous task provides possibilities commercial however additionally needs watchfulness and a deep understanding of market characteristics to browse efficiently. By comprehending the subtleties of money companies, people and markets can establish effective techniques to capitalize and hedge risks on market possibilities.

Identifying Profitable Exchange Opportunities

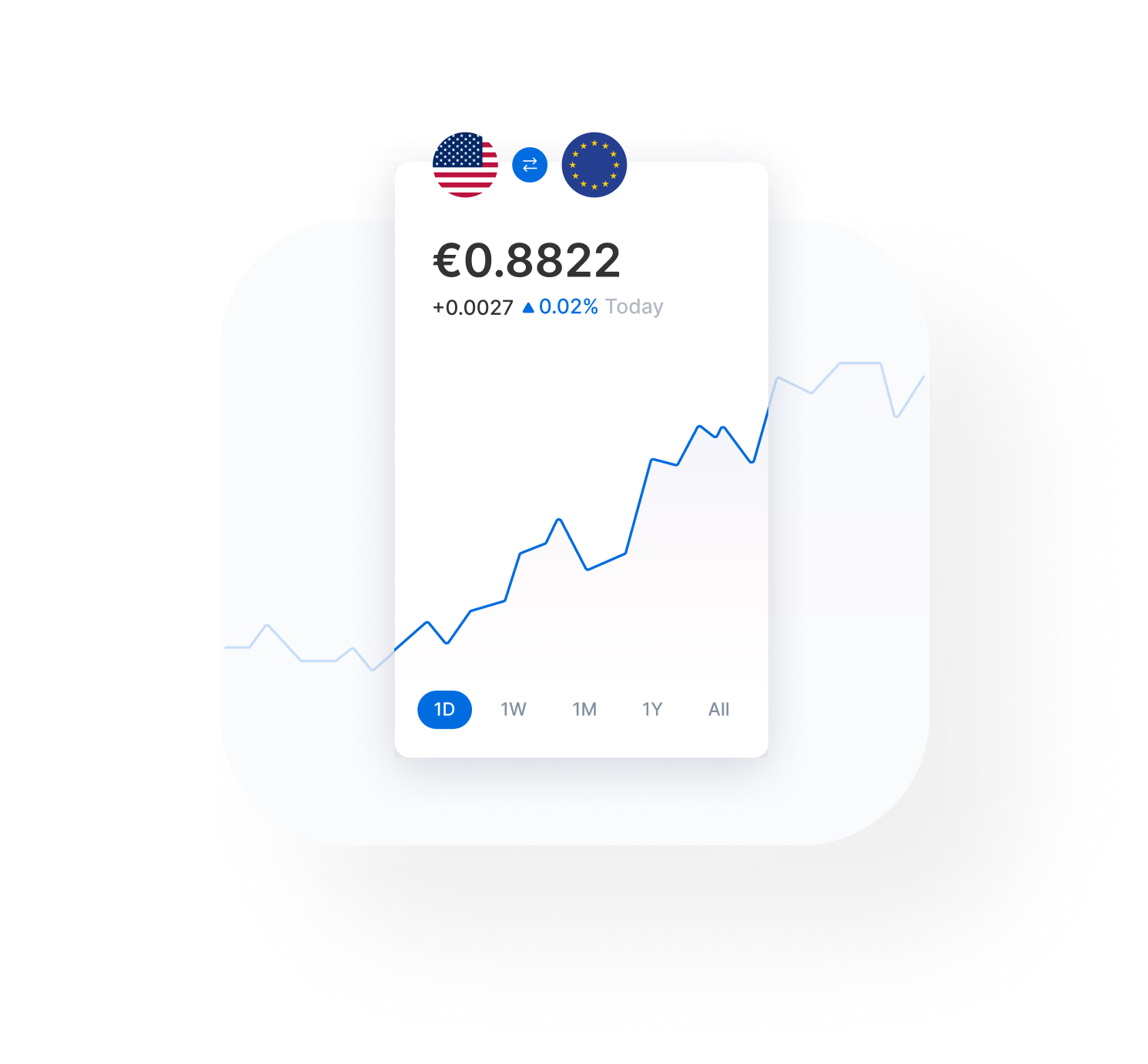

Efficient identification of profitable exchange chances is necessary for optimizing monetary gains in the realm of money trading and investment. One key method is to carefully monitor international economic indicators and geopolitical occasions that can affect currency values.

In addition, technical analysis plays a crucial function in determining fads and patterns in money prices. Utilizing devices such as relocating averages, assistance and resistance degrees, and chart patterns can aid investors spot entrance and exit points for professions. Integrating essential evaluation with technical evaluation provides a thorough strategy to recognizing rewarding exchange possibilities.

In addition, following market information and developments is essential for identifying unexpected changes in sentiment or unforeseen occasions that can impact money worths (currency exchange in toronto). By staying adaptable and cautious, traders can respond quickly to market changes and take rewarding possibilities as they emerge

Leveraging Hedging Techniques

To properly navigate the dynamic landscape of money trading and financial investment, investors have to purposefully use numerous hedging methods to protect and alleviate threats versus prospective losses. Hedging includes making use of financial instruments or strategies to counter the risks of adverse cost movements on the market. One usual hedging strategy is the usage of ahead contracts, which enable investors to secure a particular exchange rate for a future purchase, therefore securing them from fluctuations in money values.

An additional preferred hedging method is choices trading, where investors have the right yet not the commitment to get or sell a money at an established rate within a specified period. This adaptability can aid traders restrict their losses while still allowing them to profit from beneficial market activities. Furthermore, investors can use money futures contracts to hedge versus money danger by consenting to get or sell a currency at an established cost on find out here a given future date.

Tracking Economic Indicators

A thorough approach to effective money trading includes very closely monitoring vital economic indicators that can dramatically impact currency exchange rate and market trends. Economic indications are necessary devices for investors to evaluate the wellness of economic situations and make informed decisions. Some critical indicators include Gdp (GDP), rising cost of living rates, joblessness numbers, rate of interest established by reserve banks, consumer confidence indexes, and profession balances.

GDP offers insight into a country's financial efficiency, with greater GDP development typically bring about a more powerful currency. Inflation rates impact a money's purchasing power, with lower inflation generally being favorable for a currency's worth. Joblessness numbers show the labor market's wellness, affecting consumer spending and general economic stability.

Rates of interest established by main financial institutions play a substantial duty in money worth, with greater rates attracting foreign investment and strengthening the currency. Consumer confidence indexes offer a glimpse right into consumer view, influencing investing behaviors and economic development. Profession balances indicate a country's imports and exports, impacting currency strength based upon profession excess or shortages. By checking these economic indicators, traders can better anticipate market activities and maximize their money exchange approaches for optimum profitability.

Implementing Threat Monitoring Methods

Complying with a detailed analysis of essential financial signs, the effective application of risk monitoring techniques is critical in navigating the intricacies of currency trading and ensuring optimum end results. Danger monitoring browse around here in currency exchange includes identifying, examining, and prioritizing dangers, followed by collaborated application of resources to decrease, keep track of, and regulate the chance or effect of damaging events.

One essential risk administration strategy is setting stop-loss orders to restrict possible losses. These orders immediately cause a profession when a predefined price limit is reached, alleviating the threat of significant losses in unstable markets. In addition, expanding your money portfolio can aid spread danger throughout various money, decreasing susceptability to fluctuations in a single money.

Additionally, making use of leverage sensibly and maintaining adequate liquidity are important danger administration methods in money trading. Leveraging permits investors to regulate bigger positions with a smaller amount of funding however also intensifies possible losses. Therefore, it is essential to strike a balance in between leveraging for potential gains and managing risks to safeguard your investments. By carrying out these danger administration approaches, investors can improve their earnings and secure their resources in the vibrant globe of money exchange.

Conclusion

Additionally, investors can use money futures agreements to hedge against currency threat by concurring to sell a currency or buy at an established price on a given future day.

Rising cost of living prices influence a currency's buying power, with lower rising cost of living usually being favorable for a money's worth.Interest rates established by main financial institutions play a considerable duty in money value, with higher rates drawing in foreign investment and reinforcing the money. In addition, expanding your currency profile can aid spread out threat throughout different currencies, go to this site minimizing vulnerability to fluctuations in a single money.

In final thought, making the most of earnings with currency exchange approaches needs a deep understanding of money markets, the capacity to recognize lucrative exchange possibilities, leveraging hedging methods, keeping an eye on economic indicators, and applying risk monitoring methods.